Call: +628111047338 | Email: info@myglobalguru.com

ACCA - Indonesia Taxation - TX - LSAF - Indonesia Taxation

Description

You'll develop knowledge and skills relating to the tax system as applicable to individuals, single companies and groups of companies.

LSAF - Indonesia Taxation

Registration is Closed

London School of Accountancy and Finance

Mall of Indonesia Italian Walk Blok B no. 36 Kelapa Gading Square North Jakarta

, Jakarta

, Indonesia

Launch date: 20 July 2024

Registration Periode: 20 July 2024 - 30 July 2024

Class Type:

Study Mode:

Class Capacity :

- Online : Max 20 Student

- Onsite : Max 20 Student

Class Commencement Date:

20 July 2024

Course Curriculum

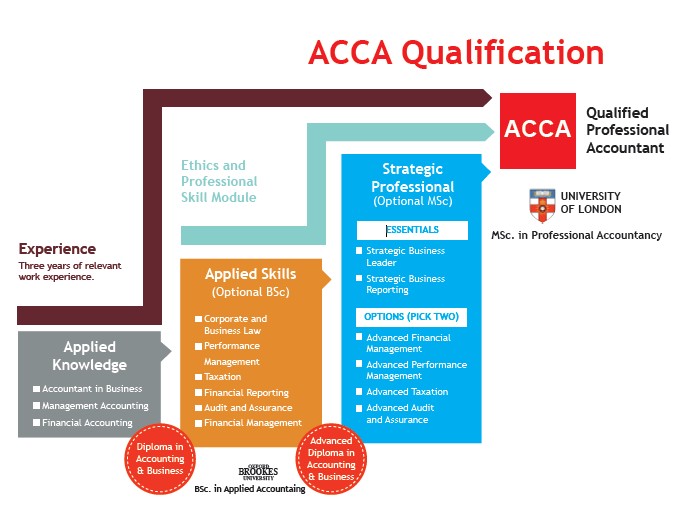

ACCA Taxation

We're here to help

Answers to common questions about why you should join

.png)